2024 Form 1040 Schedule 3 Worksheet – If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule complete this worksheet, you will need to complete Form 1040 through line . One simple way to set up your business expense worksheet is to open the IRS Form 1040 Schedule C form (See Resources) and use those expense categories to develop your own listing. When you create .

2024 Form 1040 Schedule 3 Worksheet

Source : www.irs.gov2024 2025 Additional Income Information Form

Source : gannon.eduPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

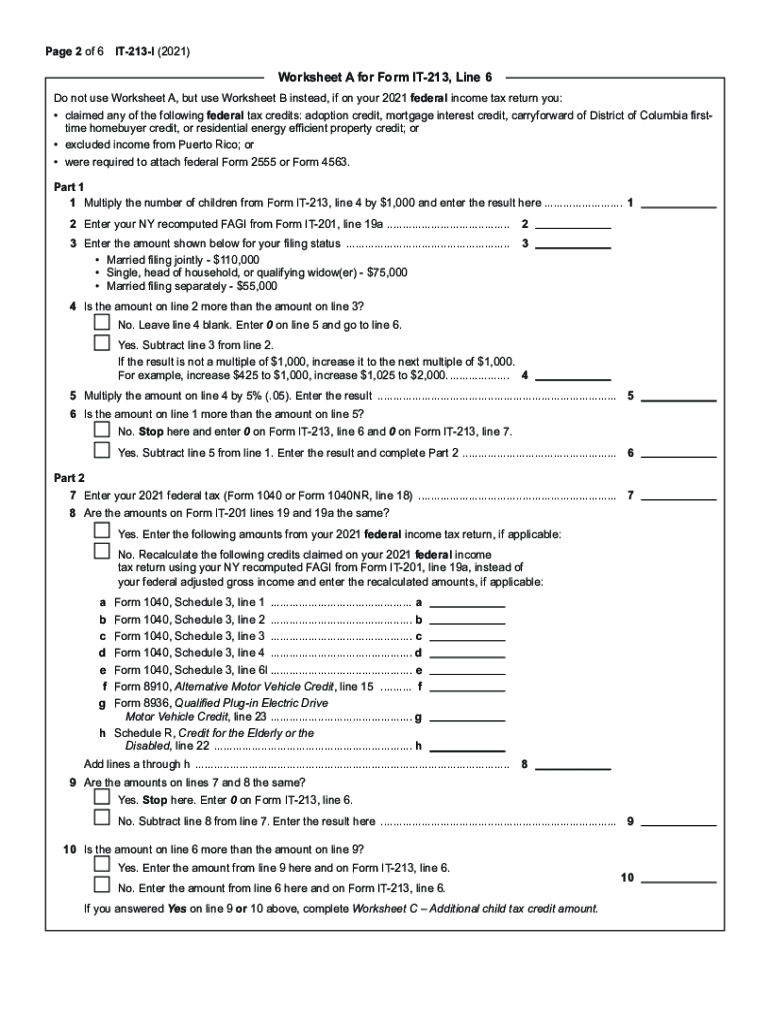

Source : www.irs.govIt 213: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 2024 Verification Worksheet Independent by Hofstra

Source : issuu.com1040 (2023) | Internal Revenue Service

Source : www.irs.govEmployee’s Withholding Certificate

Source : www.irs.gov2024 Form 1040 Schedule 3 Worksheet 1040 (2023) | Internal Revenue Service: The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). .

]]>