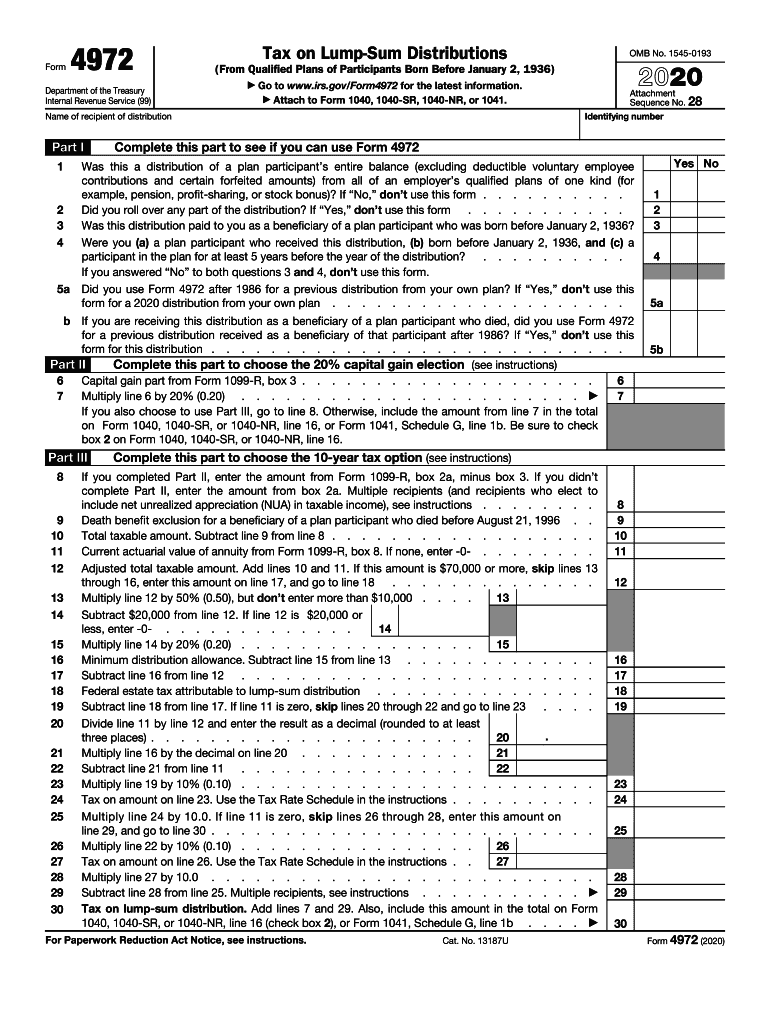

2024 Form 1040 Schedule 4972 – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . The 1099 forms are sent to you by clients you work for. Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” .

2024 Form 1040 Schedule 4972

Source : www.taxesforexpats.com2023 Form IRS 4972 Fill Online, Printable, Fillable, Blank pdfFiller

Source : form-4972.pdffiller.comForm 1040 V: Payment Voucher Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comEASE TAX SEASON WORRIES | United Way of Lee, Hendry, and Glades

Source : unitedwaylee.orgCity of El Paso, AARP offer free tax preparations | KFOX

Source : kfoxtv.comIRS Form 4972 walkthrough (Tax on Lump Sum Distributions) YouTube

Source : www.youtube.comCity of El Paso, AARP offer free tax preparations | KFOX

Source : kfoxtv.comStandard Deduction vs Itemized Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comForm 4972: Fill out & sign online | DocHub

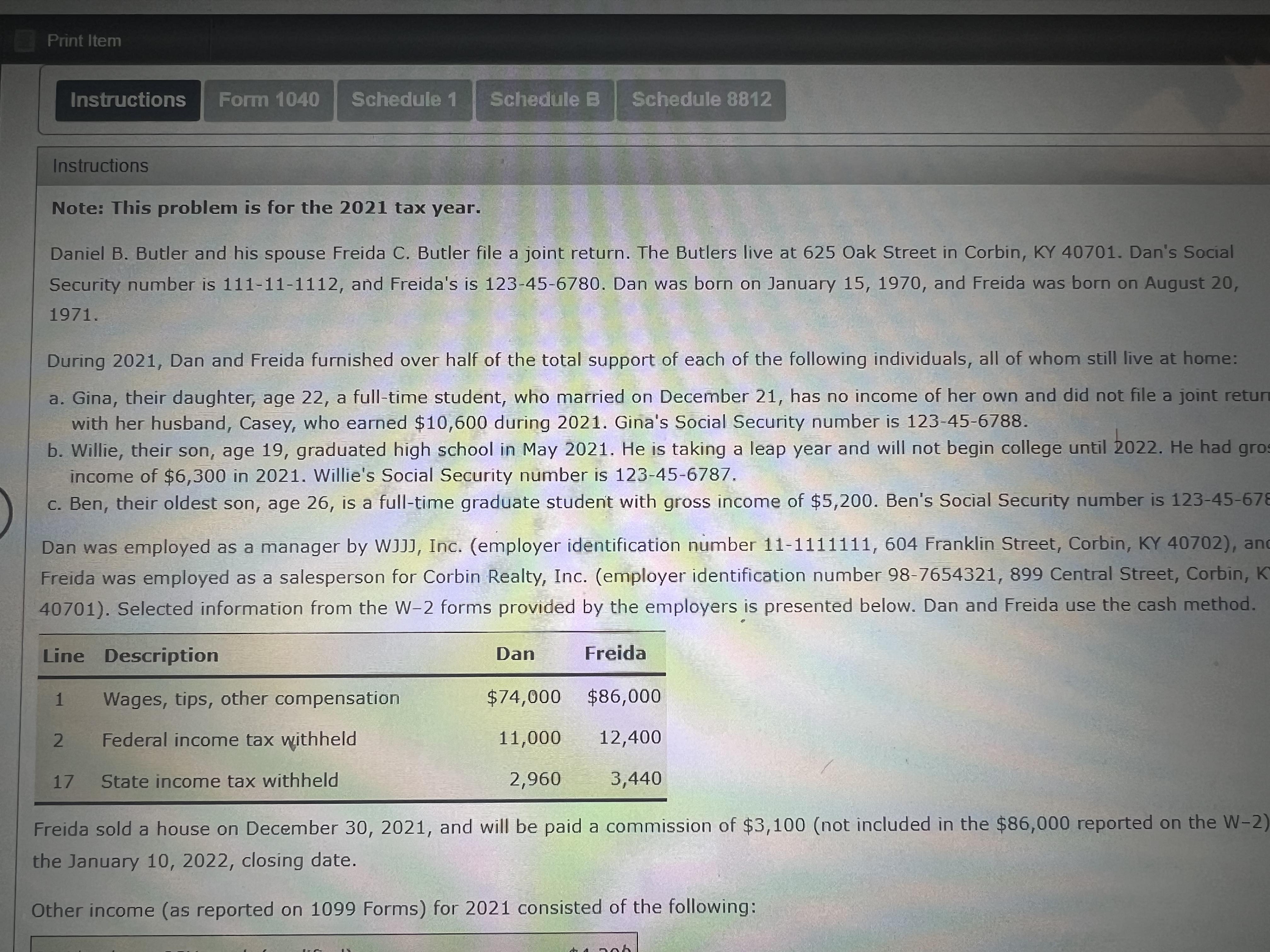

Source : www.dochub.comNote this is 2021 Tax. With following correct | Chegg.com

Source : www.chegg.com2024 Form 1040 Schedule 4972 Schedule A (Form 1040) Guide 2024 | US Expat Tax Service: Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>